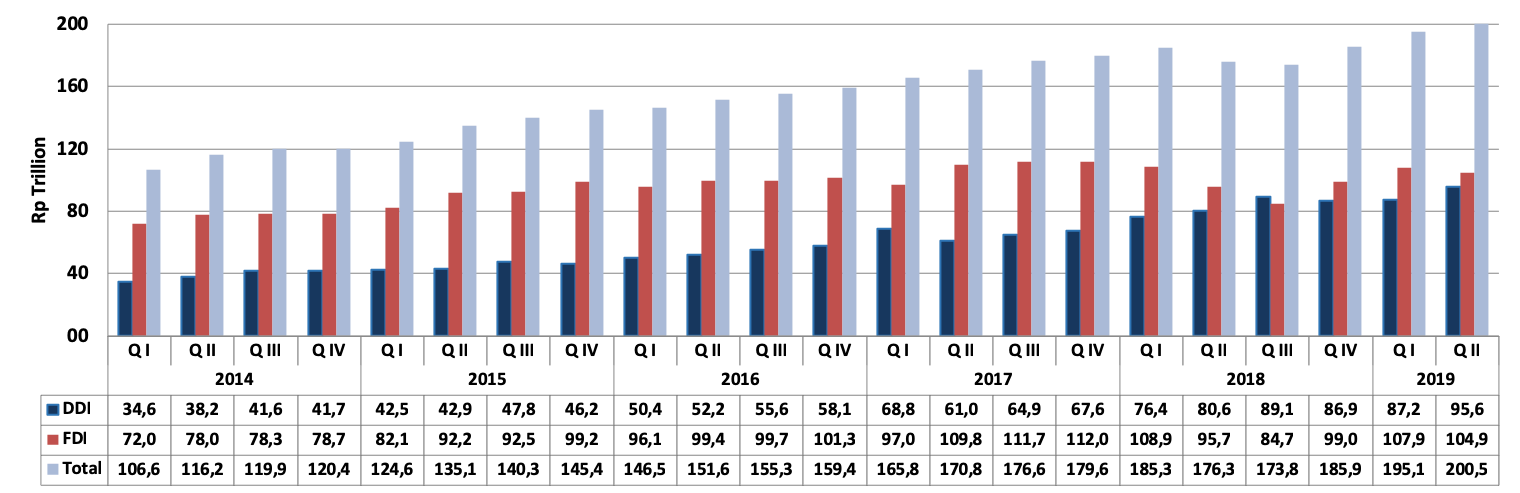

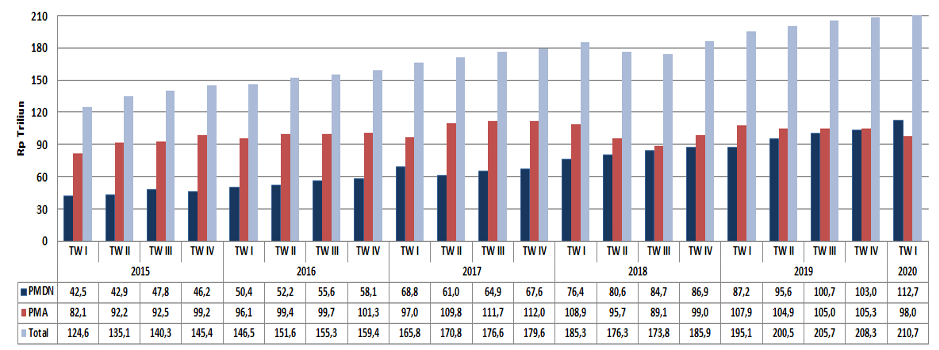

Jakarta, 20th April 2020 – Indonesia Investment Coordinating Board (BKPM) announces the first quarter (January-March) of investment realization data in 2020 reached Rp 210.7 trillion or equivalent to 8.0% increase compared to the same period in 2019, Rp 195.1 trillion. This significant value was triggered by Domestic Direct Investment (DDI) which increased by 29.3%.

Chairman of BKPM, Bahlil Lahadalia stated that the realization of this first quarter contributed 23.8% to the 2020 target investment realization of Rp 886.1 Trillion. “This first quarter quite challenging due to covid-19 outbreak, but fortunately, it is still on track, even 8% higher than first quarter of last year” said Bahlil.

Compared to the same period of 2019, Domestic Direct Investment (DDI) of this quarter increased from Rp 87.2 trillion to be Rp 112.7 trillion. In the same time, Foreign Direct Investment (FDI) decreased by 9.2%; from Rp 107.9 trillion to be Rp 98.0 trillion. Furthermore, the total domestic labor absorption in this quarter reached 303,085. It means higher than first quarter 2019 of 235.401.

“Certainly, this is a good sign, where more labor absorbed this year. We have been asking commitment of companies not to have layoff within the Covid-19 pandemic. This is important to stabilize the Indonesia’s current economy,” Bahlil said.

Bahlil also admit that the Covid-19 pandemic is challenging to the FDI investment realization in the first quarter of 2020. “BKPM hopes that foreign and domestic companies can survive in their operation, of course they are keep implementing the rules and regulations of the government. We keep continue to oversee investment projects and to facilitate debottlenecking, especially in this current conditions” Bahlil emphasized during the press conference at the BKPM office.

Investment Realization of First Quarter 2020

Within the first quarter of 2020, investment (DDI and FDI) realization in outside Java increased significantly by 19.3 %, reached Rp 102.4 trillion compared to the same period in 2019, reached Rp 85.8 trillion. At the same time, investment realization in Java slightly decreased from Rp. 109.3 trillion in 2019 to be Rp. 108.3 trillion in 2020.

BKPM also notes that investment realization (DDI & FDI) based on project locations (top 5) are: East Java (Rp. 31.4 trillion, 14.9%); West Java (Rp. 29.9 trillion, 14.2%); Special Territory of Jakarta (Rp. 20.1 trillion, 9.6%); Central Java (Rp. 19.3 trillion, 9.1%); and Riau (Rp. 12.8 trillion, 6.0%).

“Another good indication is the investment realization occurred in Eastern Indonesia, which grew by 19.3% compared to the first quarter of 2019. It was contributed by mining processing product sector, after the nickel ore export ban in the end 2019. We keep continue to promote investment realization of outside Java” said Bahlil.

Foreign and Domestic investment realization in this quarter was dominated by sector of Transportation, Warehouse, and Telecommunication (Rp 49.3 trillion, 23.4%); Basic Metal, Metal Based Goods, Non-Machinery and Equipment Industry (Rp 24.5 trillion, 11.6%); Electricity, Gas, and Water Supply (Rp 18.0 trillion, 8.6%); Housing, Industrial Estate, and Office Building (Rp 17.8 trillion, 8.4%); and Food Crops, Plantation, and Livestock (Rp 17.2 trillion, 8.2%)

The top five leading countries whose largest FDI are: Singapore (US$ 2.7 billion, 40.0%); China (US$ 1.3 billion, 18.9%); Hong Kong (US$ 0.6 billion, 9.3%); Japan (US$ 0.6 billion, 8.9%) and Malaysia (US$ 0.5 billion, 7.1%).

Through the implementation of “Large Investment Project Execution” program, BKPM remains committed to oversee the investment projects, from getting permit until solving problems in the field, such as land acquisition. “Together with other Ministries/Institutions, we keep continue to facilitate obstacles faced by companies, especially in the midst of the Covid-19 pandemic. “This is not an easy thing to do, but we are optimistic this outbreak will end soon and the economy will rebound,” Bahlil stressed.

Progress of Investment Realization from 2015 – March 2020: By Quarterly